Bookkeeper Hourly Pay at Self-Employed

Some bookkeeping, accounting, and auditing clerks become certified. For those who do not have postsecondary education, certification is a particularly useful way to gain expertise in the field. The Certified Bookkeeper (CB) designation, awarded by the American Institute of Professional Bookkeepers, shows that those who have earned it have the skills and knowledge needed to carry out all bookkeeping tasks, including overseeing payroll and balancing accounts, according to accepted accounting procedures.

You need to follow the code of ethics set in place by this organization and pass an examination to earn certification. The examination to become a Certified Bookkeeper is divided into four parts. There are preparation courses available online and at colleges to prepare you for certification. Once you have the skills and knowledge to be a great bookkeeper, it doesn’t stop there. To keep up to date with many changes and updates that happen in this field of work, you should have an interest in learning more about the position and furthering your education when the opportunity arises.

For those looking to develop and assume managerial positions, a Master’s of Business Administration (MBA) incorporates elements of management and leadership skills as well as accounting theory and practice. Be prepared to take a lot of accounting courses. Typically, these courses require practice Bookstime at maintaining financial records both manually and using computer programs. You should also take general business and management courses if you want to achieve higher level positions in your career. These courses will also be helpful if you choose to open your own bookkeeping or auditing firm.

The advantage of hourly pay is you receive 1.5 times your normal wage for hours worked in excess of 40 per week. In bookkeeping, extra hours are common during the busy season of January to April. Mid-size and small public accounting firms pay, on average, about 10% less than the Big Four.

However, important differences exist in the nature of work conducted in each career and what is required to be successful. The following analysis compares the education requirements, skills needed, typical starting salaries and job outlooks for accounting and bookkeeping. We believe that Bookkeeping and accounting is a very important part of every business.

Number of Jobs, 2018

If you’re more of an “outdoors” person who hates sitting in front of a PC for extended hours looking at numbers and figures, bookkeeping might not be for you. You https://www.bookstime.com/ may also be an ideal bookkeeping candidate if you want a good job with a respectable wage and decent security but may not be looking for a long-term career.

As the trend toward stricter government controls continues, demand will continue to rise, suggesting excellent career prospects for anyone with this skill. Bookkeepers typically keep the financial records for an organization.

- Accounting and bookkeeping are flexible careers that often allow telecommuting.

- This is a great way to let potential clients find you when they are looking for a new bookkeeper online.

- You can earn a certificate in as little as 3 to 6 months.

- As a bookkeeper, you need to be organised and have good time management skills.

- You need two years of experience to be eligible for certification.

- Most of them will have nothing in common except money, so no matter how proficient you are in bookkeeping, you might find yourself with a new employer in a line of business you know nothing about.

They work in offices and use a variety of office equipment and computer programs. They record financial transactions, produce financial reports and ensure the accuracy of records. Bookkeepers keep records of cash expenditures and receipts for their employer, and report discrepancies or issues.

The financial statements will include expenditures, debts, receipts, accounts payable and receivable, invoices, and profits. Travel may be involved for those who work for multiple clients. Depending on the position, overtime hours might be required at certain times of the year. The U.S. Bureau of Labor Statistics reported the median annual salary for bookkeeping, accounting, and auditing clerks was $40,240 in May 2018.

If you choose to work for a company internally instead of doing public accounting, the starting salary range is very broad. In most cases, private companies do not pay more than the Big Four for young accountants with little experience. Both careers, accounting in particular, cover a broad gamut of starting salaries. How much you make as a first-year accountant depends in large part on the specific career path you pursue. While accounting can be a lucrative long-term career, most accountants, unlike corporate attorneys or investment bankers, do not command huge salaries during the first few years.

5. Let Clients Book Appointments Online

This system follows the accrual basis of accounting. ABC Corp maintains its books of accounts in a single entry system of bookkeeping. The following are the financial transactions in the month of July. Read Case Studies to find out how we helped our clients with Finance and Accounting Services.

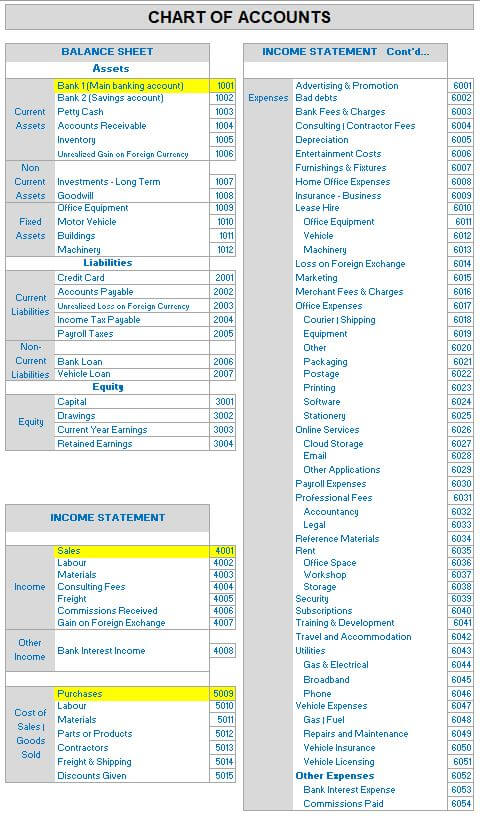

Certification for experienced bookkeepers is available through the American Institute of Professional Bookkeepers. These programs will teach you how to record costs, value inventory, calculate depreciation, analyze financial statements, and use software programs. Courses will cover topics in QuickBooks, Microsoft Excel, bookkeeping, business math, and payroll administration. Bookkeepers keep track of financial records for companies and organizations. To ensure updated and accurate financial statements, they must understand how to use spreadsheets and database software programs.

Alternatively referred to as an accounting or auditing degree, earning a book keeping degree prepares one for a career as an accountant across a variety of industries and sectors overseeing financial records. Earning an associate’s degree in book keeping is enough to get an entry level book keeping job and can be transferred into a four year university course.

The totals of the debits and credits for any transaction must always equal each other, so that an accounting transaction is always said to be «in balance.» If a transaction were not in balance, then it would not be possible to create financial statements. Thus, the use of debits and credits in a two-column transaction recording format is the most essential of all controls over accounting accuracy. Bannester, Anthony. Bookkeeping and Accounting for Small Business. Straighforward Co.

For a long-term career, accounting offers much more upward mobility and income potential. The education required to be competitive in the field is greater, but the payoff down the road can be considerably higher. That said, bookkeeping is a great starting point if you are interested in the field but not fully committed and want to test the waters.