Financial Ratios Flashcards

Balance Sheet vs. Income Statement

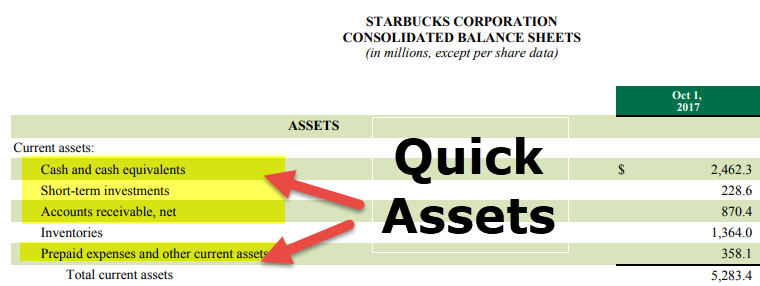

If the current ratio is lower than 1.00X, then the firm would have an issue covering its monthly payments. A higher current ratio is typically better than a lower current ratio with regard to sustaining liquidity. Quick ratio is a stricter measure of liquidity of an organization than its current ratio. While present ratio compares the entire present belongings to whole current liabilities, fast ratio compares cash and close to-cash present assets with current liabilities. Since near-cash present belongings are lower than complete current property, quick ratio is lower than current ratio except all current assets are liquid.

Quick ratio definition

Quick ratio is most useful the place the proportion of illiquid present assets to whole present assets is high. However, fast ratio is much less conservative than cash ratio, another important liquidity parameter. It is usually criticized due to its conservative measurement of stability and does not account for companies https://cryptolisting.org/blog/how-do-the-balance-sheet-and-cash-flow-statement-differ that are efficient at selling by way of inventory and amassing on A/R. In common, the upper the quick ratio is, the higher the probability that an organization will be capable of cowl its quick-time period liabilities.

How do you calculate your inventory turnover ratio?

Looking at this abstract, the corporate improved its liquidity place from 2017 to 2018, as indicated by all three metrics. The fast ratio shows that the corporate has to promote inventory to meet its present debt obligations, however the quick ratio can also be enhancing.

A quick ratio consistent with business common signifies availability of enough good quality liquidity. I suggest having a look at the pros and cons listing for every ratio to find out which may be a extra accurate measurement of your short term liquidity. If your business falls into this category, you might need to use the Quick Ratio as a result of it doesn’t embrace stock within the equation.

Definition of Current Ratio

Second, the corporate isn’t capable of utilize its property nicely and thus, the current property are rather more than present liabilities of the corporate https://cryptolisting.org/. this makes us consider that they’re in the best place to fulfill their current liabilities. Thus, the distinction between the 2 ratios is the use (or non-use) of inventory.

When operating a business, you want to have the ability to take a look at your funds at a look and see how things are going financially. The fast ratio and present ratio are two commonly used metrics by enterprise owners to keep an eye on their liquidity, or their ability to shortly repay excellent liabilities. The two ratio formulas are very similar—the only difference being their treatment of inventory. For example, let’s say that Company A has a current ratio of 5 in a given 12 months, what could be the potential interpretation? First, they’re doing exceptionally good so that they’ll liquidate their present assets so very well and pay off money owed sooner.

What are the four liquidity ratios?

Liquidity ratios greater than 1 indicate that the company is in good financial health and it is less likely fall into financial difficulties. Most common examples of liquidity ratios include current ratio, acid test ratio (also known as quick ratio), cash ratio and working capital ratio.

It wants to enhance its fast ratio to above 1.0 X so it won’t have to promote inventory to satisfy its quick-time period debt obligations. If an organization’s financials don’t present a breakdown of their fast assets, you can still calculate the quick ratio. You can subtract stock and present prepaid property from current assets and divide that distinction by present liabilities. You can subtract inventory and current prepaid property from present assets, and divide that distinction by current liabilities. The current ratio measures an organization’s ability to pay current, or brief-term, liabilities (debt and payables) with its current, or brief-time period, belongings (money, inventory, and receivables).

Analysis of Liquidity Position Using Financial Ratios

A company should posses the flexibility to release money from money cycle to satisfy its monetary obligations when the creditors seek payment. In different phrases, an organization ought to posses the ability to translate its brief time period property into money. Liquidity ratios are the ratios that measure the ability of a company to satisfy its brief term debt obligations. These ratios measure the ability of a company to pay off its short-term liabilities after they fall due.

- When your stock is managed well, it could possibly lead to lengthy-time period success for your business, making your inventory turnover ratio an necessary subject to know and perceive.

- A nicely-established enterprise may regularly collect its receivables in a short time period—10 days, for example—from financially stable longstanding purchasers.

- Current property listed on an organization’s stability sheet embrace cash, accounts receivable, stock and different property which are anticipated to be liquidated or was money in less than one 12 months.

- Sometimes referred to easily as a debt ratio, it’s calculated by dividing an organization’s total debt by its whole belongings.

- The quick ratio is a liquidity ratio, like the present ratio and cash ratio, used for measuring a company’s short-time period monetary well being by evaluating its current property to current liabilities.

- Each financial ratio needs to be analyzed towards the backdrop of what’s typical for the trade.

However, on this case, the agency must sell stock to pay its brief-time period debt. So, the agency improved its liquidity by 2018 which, on this case, is sweet, as it’s operating with relatively low liquidity.

What does a current ratio of 3 mean?

The current ratio is a popular metric used across the industry to assess a company’s short-term liquidity with respect to its available assets and pending liabilities. A ratio over 3 may indicate that the company is not using its current assets efficiently or is not managing its working capital properly.

With a quick ratio of zero.94, Johnson & Johnson appears to be in a good position to cover its present liabilities, though its liquid assets aren’t quite capable of meet each dollar of brief-time period obligations. Procter & Gamble, then again, might not be able to repay its present obligations using bookkeeping solely quick property as its quick ratio is properly below 1, at 0.51. The current ratio reveals whether or not a company has enough access to money to continue operations after paying off present liabilities. Working capital is the dollar amount by which present property exceed present liabilities.

Why high current ratio is bad?

A current ratio that is lower than the industry average may indicate a higher risk of distress or default. Similarly, if a company has a very high current ratio compared to their peer group, it indicates that management may not be using their assets efficiently.

Consequently, the extra reliable measure of quick-term liquidity is the quick ratio. It’s important to include other financial ratios in your analysis, including each the current ratio and fast ratio, as well as others. If an organization has a current ratio of lower than one then it has fewer present assets than present liabilities. Creditors would think Bookkeeping about the company a financial danger as a result of it may not be capable of easily pay down its quick-term obligations. The most basic definition of acid-check ratio is that, “it measures current (short term) liquidity and place of the corporate”.

Quick ratio depicts the liquidity place of the company, i.e. how shortly the company is capable of assembly its urgent cash requirement. It determines the company’s efficiency in utilizing quick property or say liquid assets in discharging the current liabilities instantly. Current Ratio is a measure of the corporate How to Calculate Interest Rates on Bank Loans?’s effectivity in covering its money owed and payables with its present property, which are going to fall due for cost, inside a interval of one 12 months. A larger current ratio displays the company’s capability in paying off its obligations.

Working capital is the quantity by which the value of a company’s present belongings exceeds its current liabilities. Sometimes the term «working capital» is used as synonym for «present assets» but extra regularly as «net working capital», i.e. the quantity of current belongings that is in excess of present liabilities. Working capital is frequently used to measure a agency’s ability to satisfy present obligations. It measures how a lot in liquid property a company has available to construct its business.

The current ratio, also referred to as the working capital ratio, measures the business’ capability to repay its brief-term debt obligations with its present assets. Some are mounted in nature after which there are current belongings and current liabilities. The liquidity ratios deal with the connection between such present belongings and current liabilities. This is a good financial position for a agency, which means that it could possibly meet its brief-time period debt obligations with no stress.

Inventory is a questionable merchandise to include in an evaluation of the liquidity of a enterprise, since it can be quite tough to convert to cash in the brief term. Even if it may be offered inside a fairly short time period, it is now a receivable (if bought on credit), and so there’s a further wait till the customer pays the receivable.

The present ratio is the ratio utilized by company entities to check the flexibility of the company to discharge brief-time period liabilities, i.e. within one yr. Conversely, quick ratio is a measure of an organization’s efficiency in meeting its current monetary liabilities, with its quick belongings, i.e. the belongings which are simply convertible to money in a brief period.

What is a good inventory turnover ratio?

What is the best inventory turnover ratio? For many ecommerce businesses, the ideal inventory turnover ratio is about 4 to 6. All businesses are different, of course, but in general a ratio between 4 and 6 usually means that the rate at which you restock items is well balanced with your sales.

From this calculation, you realize you’ve positive net working capital with which to pay short-term debt obligations earlier than you even calculate the present ratio. You should be capable of see the connection between the company’s net working capital and its present ratio.

Limitations of Using the Current Ratio

When analyzing a company’s liquidity, no single ratio will suffice in every circumstance. It’s important to include other monetary ratios in your analysis, including each the current ratio and quick ratio as well as others. Current Ratio, is a measure of a company’s liquidity and solvency, in paying off its short time period obligations.